Health insurance is a crucial element in safeguarding your well-being and financial stability. In today's unpredictable healthcare landscape, understanding the various health insurance plans and their key components can empower individuals and families to make informed decisions. This guide delves into the significance of health insurance, the different types available, and how to effectively navigate the complex market to ensure you have the right coverage.

Through a comprehensive overview, we'll explore the importance of health insurance, the financial protection it offers against soaring healthcare costs, and the vital role it plays in accessing essential medical services and preventive care. Preparing to understand your options is the first step towards a healthier future.

Understanding Health Insurance

Health insurance is a type of insurance coverage that pays for medical expenses incurred by the insured. It serves as a protective measure against high healthcare costs, ensuring that individuals have access to necessary medical services without facing financial hardship. Health insurance plans vary widely in their coverage, costs, and structures, which can significantly influence an individual's healthcare experience.Health insurance plans can be categorized into several types, each designed to meet different needs and preferences. The most common types include:Types of Health Insurance Plans

Health insurance plans can be classified based on their networks, coverage options, and payment structures. Understanding these different types helps consumers choose a plan that best suits their lifestyle and healthcare requirements.- Health Maintenance Organization (HMO): This type requires members to choose a primary care physician (PCP) and get referrals for specialist care. HMOs often offer lower premiums and out-of-pocket costs.

- Preferred Provider Organization (PPO): PPOs provide more flexibility in choosing healthcare providers and do not require referrals for specialists. While premiums may be higher, they allow for out-of-network care.

- Exclusive Provider Organization (EPO): EPOs combine features of HMOs and PPOs, offering lower premiums without requiring referrals but limiting coverage to a specific network of providers.

- Point of Service (POS): POS plans blend HMO and PPO features, requiring a primary care physician while allowing for out-of-network services at a higher cost.

- High Deductible Health Plan (HDHP): These plans have higher deductibles and lower premiums, often paired with Health Savings Accounts (HSAs) to help cover out-of-pocket costs.

Key Components of a Health Insurance Policy

Each health insurance policy comprises essential components that determine the plan's coverage, costs, and overall value. Understanding these components is crucial for making informed choices regarding healthcare coverage.- Premium: This is the amount paid for the insurance policy, typically billed monthly. It represents the cost of maintaining health insurance coverage, regardless of whether medical services are utilized.

- Deductible: The deductible is the amount the insured must pay out-of-pocket before the insurance company begins to cover medical expenses. Deductibles can vary significantly between plans and can influence overall healthcare costs.

- Out-of-Pocket Maximum: This is the maximum amount an individual or family will have to pay in a given year for covered medical expenses. Once this limit is reached, the insurance company covers 100% of the costs for the remainder of the year.

"The balance between premiums, deductibles, and out-of-pocket maximums often defines the suitability of any health insurance plan for an individual or family."The integration of these components can significantly impact the affordability and accessibility of healthcare services, making it essential for consumers to analyze their options thoroughly.

The Importance of Health Insurance

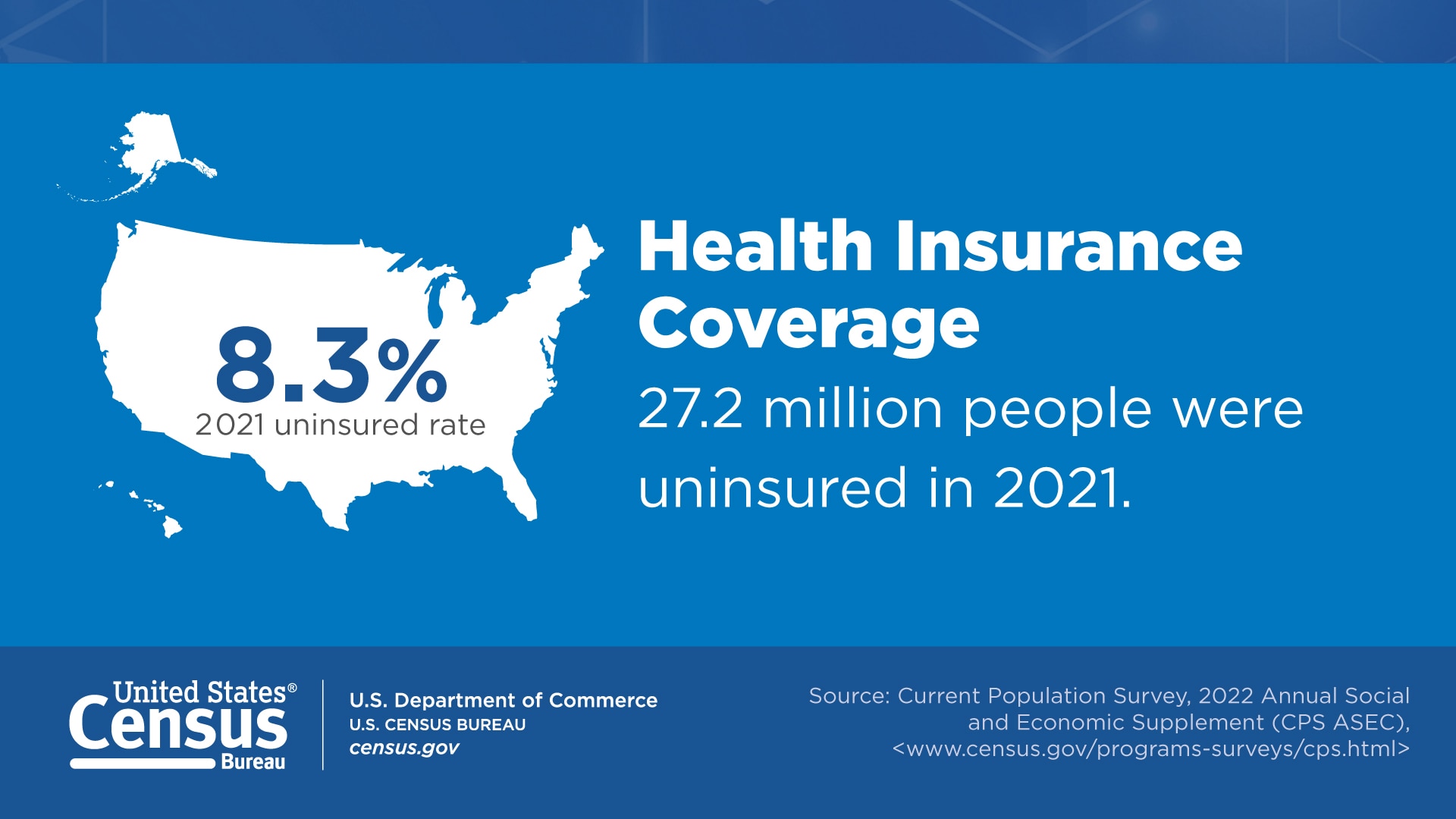

Health insurance plays a crucial role in safeguarding individuals and families against the high costs associated with healthcare. It provides a safety net that ensures access to necessary medical services without the burden of overwhelming debt. As healthcare expenses continue to rise, having health insurance becomes not just a financial plan but a vital necessity for maintaining well-being.The benefits of health insurance extend beyond just financial protection. It enables individuals to seek timely medical attention, access preventive services, and manage chronic conditions effectively. Without insurance, many may forego necessary care, leading to deteriorating health outcomes. The following points highlight the significance of health insurance in today's healthcare landscape.Financial Protection from Healthcare Costs

The financial implications of healthcare can be staggering, with average costs increasing year over year. For instance, the average annual premium for employer-sponsored health insurance was approximately $7,739 for single coverage and $22,221 for family coverage in 2021, according to the Kaiser Family Foundation. The exorbitant costs of hospital stays, surgeries, and specialist consultations can lead to devastating financial consequences for those without insurance.Key statistics underscore the importance of health insurance in mitigating these financial risks:- Individuals without health insurance are 6 times more likely to incur catastrophic medical expenses.

- The average hospital stay can cost over $10,000, a figure that can be unmanageable without insurance.

- Emergency room visits can range from $150 to over $3,000 depending on the treatment required.

Access to Medical Services and Preventive Care

Access to medical services is another critical aspect of health insurance that enhances overall health outcomes. Insured individuals are more likely to receive regular check-ups and preventive care, which are essential for early diagnosis and treatment of diseases. Health insurance plans typically cover preventive services such as vaccinations, screenings, and annual check-ups without additional costs.The impact of health insurance on preventive care can be illustrated by the following points:- Preventive services can lead to early detection of serious illnesses, potentially saving lives.

- Health insurance encourages individuals to seek routine care, thus reducing the risk of chronic conditions escalating.

- Many health plans provide coverage for mental health services, promoting comprehensive well-being.

Navigating the Health Insurance Market

Step-by-step Guide to Selecting the Right Health Insurance Plan

The first step in choosing an appropriate health insurance plan involves a careful evaluation of your current health status and anticipated medical needs. Consider the following:- Assess Your Health Needs: Identify any ongoing medical conditions, medications, or expected treatments that will require coverage.

- Determine Your Budget: Establish how much you can afford in terms of premiums, deductibles, and out-of-pocket expenses.

- Research Plan Types: Understand the differences between HMO, PPO, EPO, and POS plans to see which fits your needs best.

- Check Provider Networks: Ensure that your preferred healthcare providers and facilities are included in the plan's network.

- Evaluate Prescription Coverage: Verify that necessary medications are covered under the plan formulary.

- Read Customer Reviews: Look for feedback on claims processes and customer service from current or past members.

Comparison of Health Insurance Providers

To make an informed choice, comparing various health insurance providers and their offerings is critical. Below is a summary of some leading companies and their plan features:| Provider | Plan Types | Average Premium | Key Features |

|---|---|---|---|

| Provider A | HMO, PPO | $300/month | Low deductibles, extensive network |

| Provider B | PPO, EPO | $350/month | Flexible provider access, good for specialists |

| Provider C | HMO | $250/month | Lower out-of-pocket costs, preventative care |

| Provider D | PPO | $400/month | High coverage for out-of-network, robust support |

Enrollment Process for Obtaining Health Insurance

The enrollment process for health insurance is critical and varies by provider, but key elements remain consistent across most plans. Understanding the timeline and requirements will ensure a smooth experience.To enroll in health insurance, follow these general steps:- Review Open Enrollment Period: Most plans have a specific open enrollment period each year. For 2024, it typically starts on November 1 and ends on December 15.

- Gather Required Information: Prepare necessary documentation, such as proof of income, social security numbers, and identification.

- Complete the Application: Fill out the application form accurately, choosing the plan that fits your needs as Artikeld in previous steps.

- Submit Your Application: Ensure your application is submitted before the deadline to avoid lapsing into a waiting period.

- Review the Confirmation: After submission, review the confirmation of your enrollment to verify that the details are correct.

"Understanding the enrollment deadlines and following the necessary steps ensures uninterrupted health coverage."

Health Insurance and Legislative Changes

The landscape of health insurance is continually shaped by legislative changes that can significantly impact policies and coverage options available to consumers. Understanding these changes is crucial for navigating the complexities of health insurance and ensuring adequate coverage. Recent legislative efforts have focused on expanding access, increasing affordability, and enhancing the quality of care for individuals and families across the nation.Recent Legislative Changes Affecting Health Insurance

In recent years, several key legislative changes have influenced the health insurance market, particularly through the Affordable Care Act (ACA) and subsequent amendments. Notable adjustments have aimed to strengthen protections for consumers and expand coverage options. Among these changes are the following:- The expansion of Medicaid in numerous states, which has provided coverage to millions who were previously uninsured.

- Increased subsidies for health insurance premiums, making coverage more affordable for individuals and families, particularly those with low to moderate incomes.

- Enhanced enrollment periods to allow more flexibility for individuals seeking health insurance, particularly in response to the COVID-19 pandemic.

Government Programs Providing Health Insurance

Government programs such as Medicare and Medicaid are foundational to the U.S. health insurance landscape, providing essential coverage to specific population groups. Medicare primarily serves individuals aged 65 and over, as well as some younger individuals with disabilities, while Medicaid offers coverage to eligible low-income individuals and families. The criteria and benefits of these programs are key to understanding the broader context of health insurance.- Medicare includes different parts: Part A covers hospital insurance, Part B covers outpatient services, and Part D offers prescription drug coverage.

- Medicaid offers a comprehensive benefits package, including hospital care, long-term care, and preventive services, tailored to meet the needs of low-income populations.

- Both programs have seen enhancements in benefits and coverage options in recent years, making them more responsive to the needs of beneficiaries.

Potential Future Trends in Health Insurance

Looking ahead, several trends in health insurance are expected to shape the future landscape, affecting both providers and consumers. These trends include advances in technology, a shift towards value-based care, and ongoing legislative adjustments.- The integration of telehealth services, which gained prominence during the pandemic, is likely to remain a staple in health care delivery, offering convenience and accessibility to patients.

- Value-based care models aim to improve patient outcomes while controlling costs, rewarding providers who deliver high-quality care.

- Anticipated changes in legislative measures may further expand coverage, particularly for mental health and preventive services, as awareness of these issues continues to grow.

General Inquiries

What is health insurance?

Health insurance is a contract that provides financial coverage for medical expenses incurred by the insured.

Why do I need health insurance?

Health insurance protects you from high healthcare costs and ensures access to necessary medical services.

What are premiums and deductibles?

Premiums are the monthly payments for health insurance, while deductibles are the amounts you pay out-of-pocket before coverage kicks in.

How do I choose the right health insurance plan?

Consider your healthcare needs, budget, and the specific benefits offered by different plans when selecting coverage.

What is the enrollment process for health insurance?

The enrollment process typically involves selecting a plan and submitting any required documentation during designated enrollment periods.

Finding the right coverage doesn't have to be a daunting task. When searching for insurance near me , it's essential to consider local providers who understand your specific needs. This way, you can ensure that you receive the best service and support tailored to your area.

If you're a Spanish speaker looking for comprehensive coverage options, exploring freeway insurance español can be incredibly beneficial. This service offers resources in Spanish, making it easier for you to understand your options and select the right plan that fits your lifestyle.